10 Ways to Get Top Dollar When Selling a Home.

April 6, 2017

7 Steps to Homeownership

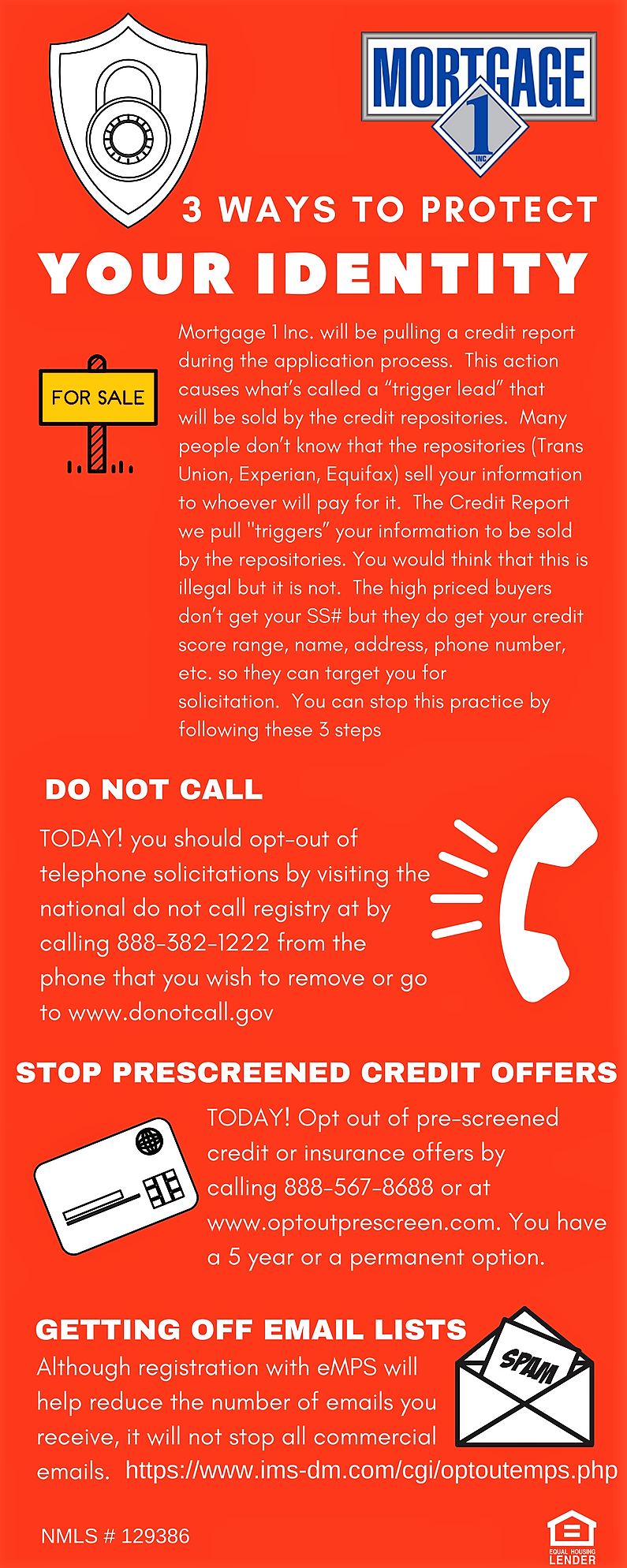

April 21, 2017Mortgage 1 Inc. will be pulling a credit report during the application process.

This action causes what’s called a “trigger lead” that will be sold by the credit repositories. Many people don’t know that the repositories (Trans Union, Experian, Equifax) sell your information to whoever will pay for it. The Credit Report we pull “triggers” your information to be sold by the repositories. You would think that this is illegal but it is not. The high priced buyers don’t get your SS# but they do get your credit score range, name, address, phone number, etc. so they can target you for solicitation. You can stop this practice by following these 3 steps;

- Do Not Call List – Opt-out of telephone solicitations by visiting the national do not call registry at by calling 888-382-1222 from the phone that you wish to remove or go to www.donotcall.gov

- Stop Prescreened Credit Offers. – Opt out of pre-screened credit or insurance offers by calling 888-567-8688 or at www.optoutprescreen.com.You have a 5 year or a permanent option.

- Getting off Email Lists. – Although registration with eMPS will help reduce the number of emails you receive, it will not stop all commercial emails. https://www.ims-dm.com/cgi/optoutemps.php

Please let your Mortgage 1 Loan officer know that you have completed the first two steps. We don’t want to pull credit until 5 days after these have been completed in order to avoid most of the selling of your personal information from being sold as a trigger lead. Ready to get started? Try our digital Mortgage called Mortgage in a SNAP

3 Ways to Protect Your Identity