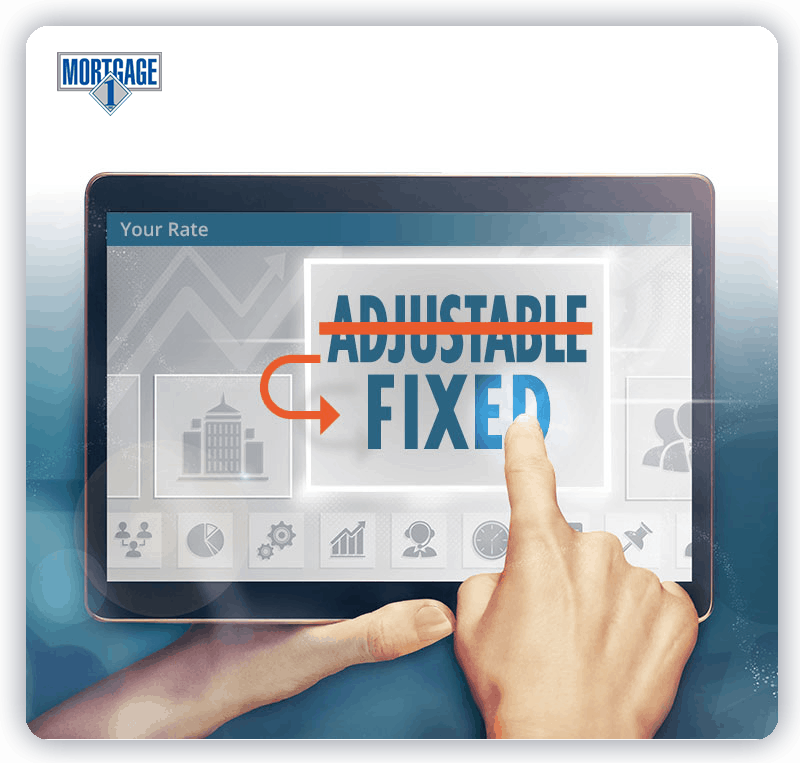

Rate & Term Reduction

Consumers can save big when they replace a 30-year mortgage with a lower interest rate, or with a shorter term. The term is the duration of the loan, when you go from a 30-year loan to a 15-year loan the payment will be slightly higher but the loan will be paid off in half the time.

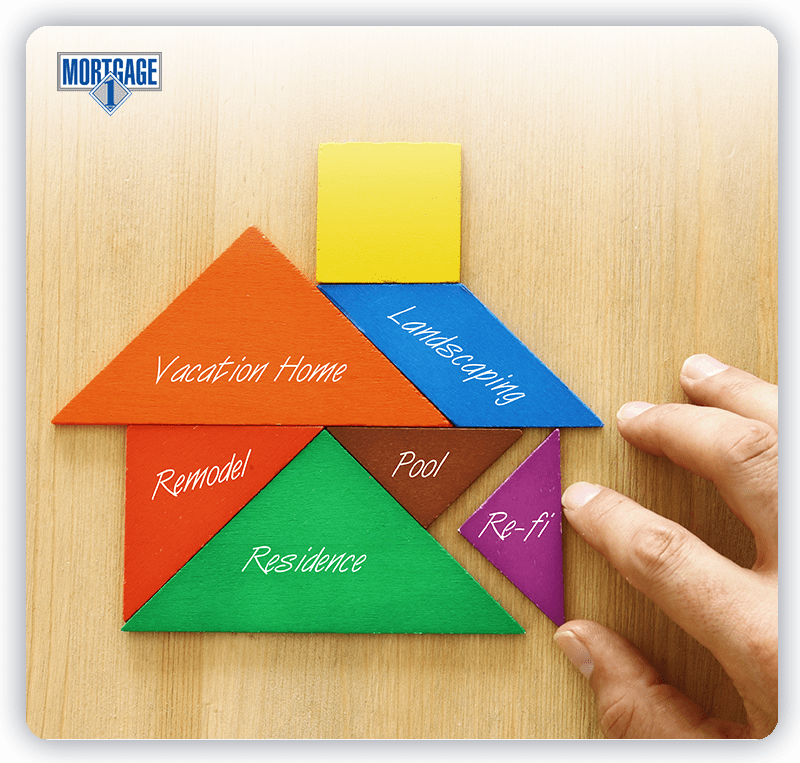

Cash out Refi

Typically mortgages carry the lowest interest rates. When homeowners are considering borrowing money for home repairs, paying off high-interest debt or other investments a cash-out refinance can be the best option. Now could be the right time to take advantage of the recent market appreciation.