Is Buying a Condo Right for You?

October 24, 2023

How to Save Money for a House

November 15, 2023Are you tired of dealing with your landlord? Do you dream of owning your own home? Well, you’re in luck because, with a low down payment, you can finally kiss renting goodbye and embrace the joys of homeownership!

| Goodbye Renting, Hello Homeownership With rent prices skyrocketing, there’s no better time to buy. Call us at 1-866-532-0550 or get preapproved today with our easy-to-use digital preapproval app. It takes as little as 15 minutes. |

Why Rent When You Can Own?

When you rent a home, you are essentially paying someone else’s mortgage. Plus, you’re virtually throwing money away every month without building any equity. So why not put that hard-earned cash towards something that’s truly yours?

With each mortgage payment you make, you’re not just securing a roof over your head; you’re steadily building equity in an asset that’s yours. You’re essentially paying yourself, investing in an asset that can provide long-term stability and the potential for financial growth. So why continue paying someone else’s mortgage when you could be building your own wealth through homeownership?

Disadvantages of Renting

Renting comes with its fair share of frustrations. You’re at the mercy of your landlord, who can increase your rent or terminate your lease at any time. Let’s explore various reasons many homeowners choose to buy rather than rent.

Limited Control and Flexibility

Renting a home often means you have limited control over the property. You may be subject to the rules and regulations the landlord or property management company sets. This lack of control can be frustrating, especially if you have specific preferences or wish to make changes to the property. Additionally, renting typically has restrictions on pets, renovations, and even decor choices.

No Ownership or Equity

One of the most significant disadvantages of renting is the lack of ownership and equity. When you rent, you are essentially paying for someone else’s investment. Unlike homeownership, where monthly mortgage payments contribute to building equity, renting offers no long-term financial benefit. Renting is essentially a temporary solution, leaving you with nothing to show for your payments once the lease is up.

Rising Rental Costs

Another disadvantage of renting a home is the potential for rising rental costs. Landlords can increase rent at the end of each lease term, leading to unpredictable expenses. This lack of stability can make financial planning challenging and strain your budget. On the other hand, owning a home gives you predictable mortgage payments, providing stability and peace of mind.

Limited Personalization

Renting can also limit your ability to personalize your living space. Most landlords have strict guidelines regarding modifications, leaving you unable to truly make the home your own. Whether painting the walls, changing fixtures, or even hanging artwork, renting often means sacrificing the freedom to express your personal style and create a space that truly reflects your personality.

The Low Down Payment Advantage

One of the most significant barriers to homeownership is the hefty down payment required. But guess what? Thanks to various loan programs and down payment assistance options, you can secure a mortgage with a low down payment. This means you can say goodbye to your landlord sooner than you think!

Low down payment options open the door to a world of possibilities. Here’s why it’s an opportunity worth seizing:

- Affordability: Making a low down payment allows you to enter the real estate market sooner. This can be especially advantageous in areas with rapidly rising home prices, ensuring that you don’t get priced out of the market.

- Less Financial Strain: A lower down payment requirement means you don’t have to deplete your savings or wait years to accumulate a significant sum of money. This can relieve financial stress and give you peace of mind.

- Accelerated Equity Building: While a low down payment may mean a higher mortgage balance, the potential for your home’s value to appreciate over time can quickly offset this difference. As your property appreciates, you build equity, and your investment grows.

- Tax Benefits: Homeownership comes with potential tax deductions, which can help offset the cost of your mortgage. Consult with a tax professional to understand how these deductions can work in your favor.

- Freedom and Personalization: When you own your home, you can personalize it, make improvements, and create the living space you’ve always envisioned.

Exploring Low Down Payment Options at Mortgage 1

Buying a home doesn’t have to be overwhelming, especially when it comes to the down payment. Many potential homebuyers assume they need a large sum of money upfront, but that’s not necessarily the case. Several low-down payment options can help you start your homeownership journey without breaking the bank.

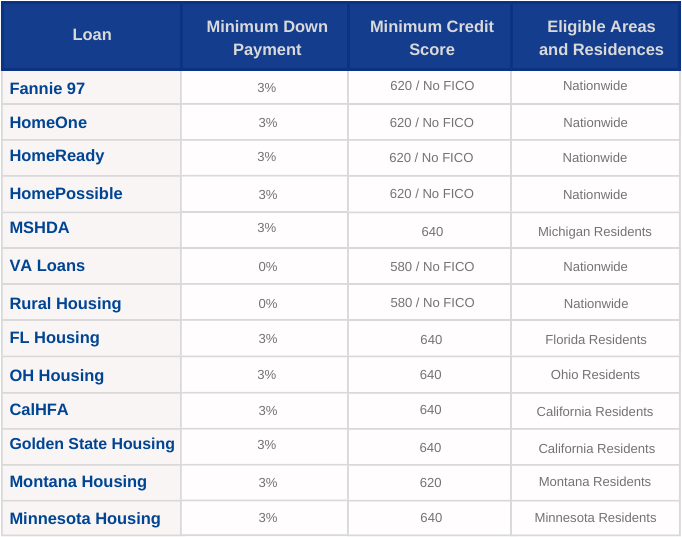

Here are some of our most popular low-down-payment loan options that homebuyers choose.

Mortgage 1 is here to help you say goodbye to rent and say hello to the joys and benefits of owning your own home! Our local loan officers specialize in helping you navigate low down payment options, tailoring financing solutions to your unique needs. They bring expert local real estate market knowledge, streamlining the often complex homebuying process. With access to various mortgage programs, including government-backed loans, Mortgage 1 is key to building equity and achieving long-term financial stability.

Don’t let down payment concerns hold you back. Contact a local loan officer at Mortgage 1 today and start your path to homeownership.