Property Inspection Waiver

September 22, 2017

Big News for Michigan home buyers!

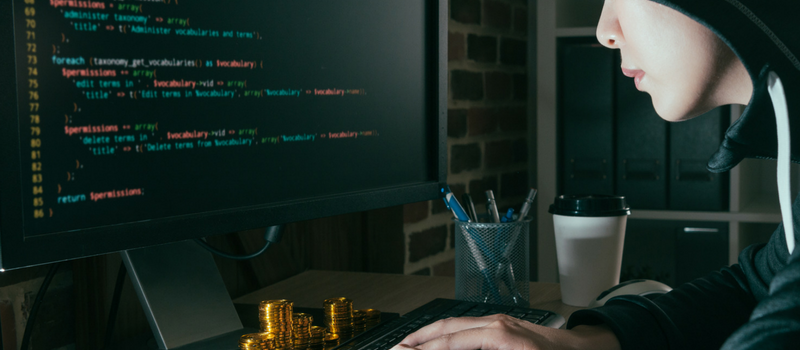

October 20, 2017Wire Fraud Protection tips.

Wire fraud is one of the fastest growing forms of fraud for consumers and financial institutions involved in real estate transactions. Many times consumers will let their guard down during the mortgage process leaving them vulnerable to lookalike emails. Some of the emails may try to get the borrowers to wire transfer funds for their mortgage to an account they control or asking them for personal information. The consumer believes that they are providing the information to their financial institution but in reality, they are providing it to the criminal.

According to the FBI, the number of wire fraud scams reported by title companies to the Internet Crime Complaint Center spiked 480 percent in 2016. Perpetrators monitor real estate transactions to perfectly time their fraudulent requests for changes in payment type (frequently from check to wire transfer) or changes in payment destination.

There are two common wire fraud scams;

- Email Compromise. This scam targets consumers working with suppliers and/or businesses that regularly perform wire transfer payments.

- The second is called Email Account Compromise. This targets individuals who perform wire transfer payments.

The FBI said criminals seeking to steal roughly $5.3 billion through this type of fraud.

Mortgage 1 will always remain vigilant against this type of fraud through clear communication with our borrowers at all times. Homebuyers should always never open unsolicited links or attachments, and avoid sending sensitive financial information by email.

If you receive requests for wringing money, verify the information with your lender using an independently verified phone number and confirm wiring information.

Here are a few tips consumers should keep in mind during the mortgage process.

- Discuss the closing process with your real estate, Mortgage lender and settlement agent.

- When you do get the closing instructions to call your Real Estate Agent to verify the accuracy of the instructions.

- If you receive an email requesting that you send money in connection with the closing, even if it’s from a familiar source, STOP. Call your loan officer or

Wire Fraud Precautions

settlement agent to discuss. Don’t use phone numbers or links in the email.

- Never email financial information. Email is not a secure way to send financial information.

- Be cautious about opening attachments and downloading files from emails, regardless of who sent them. These files can contain malware that can weaken your computer’s security.

- Before sending any wire transfer, ask your bank for help identifying any red flags in the wiring instructions. Red flags include potential discrepancies between the account name and the name of the intended beneficiary (settlement agent or lender). Your bank may also be able to compare the receiving account number to account numbers identified in past consumer complaints as the destination of fraudulent transactions.

- Confirm receipt of the wire transfer by your lender or Title Company a few hours after the wire was transmitted.

Wire Fraud Protection tips.

Ready to get started? Try our digital Mortgage called Mortgage in a SNAP