8 Reasons a Borrower Should Choose an FHA Mortgage

March 16, 2017

10 Ways to Get Top Dollar When Selling a Home.

April 6, 2017What are The Advantages of VA Mortgages?

The VA Home Loan is the most powerful home buying tool in the industry. The GI Bill reshaped post-War America, and the VA Loan Guaranty Program has surged since the housing crash. VA Mortgages help Service members, Veterans, and eligible surviving spouses become homeowners. As part of our mission at Mortgage 1 and our most rewarding, we are pleased to announce we are one of the top two lenders in our home market in 2016. VA guarantees a portion of the loan, enabling Mortgage 1 Inc. to provide more favorable terms.

What are the Advantages of VA loans?

- Primary Residence Only

- NO Mortgage Insurance

- Max Loan Amount: $424,100 (Up in 2017)

- FICO 620+

- The mortgage can be Assumable for Other Veterans

- Flexible Down Payment Options.

Purchase Loans help you purchase a home at a competitive interest rate often without requiring private mortgage insurance.

Interest Rate Reduction Refinance Loan: also called the Streamline Refinance Loan can help you obtain a lower interest rate by refinancing your existing VA loan.

How to Apply

Purchase Loan & Cash-Out Refinance: VA loans are obtained through a lender of your choice once you obtain a Certificate of Eligibility. You can obtain a COE through eBenefits, by mail, and often through your lender.

Adapted Housing Grants: You can apply for a SAH or SHA grant by either downloading or completing VA Form 26-4555 (PDF) and submitting it to your nearest Regional Loan Center, or completing the online application.

What Seller Contributions are allowed under the VA program? 100% of Closing costs and up to 4% on

- VA Funding Fee

- Paying off Debt/Judgment

- Pre-paid items

Ready to get started? Try our digital Mortgage called Mortgage in a SNAP

Advantages of VA loans

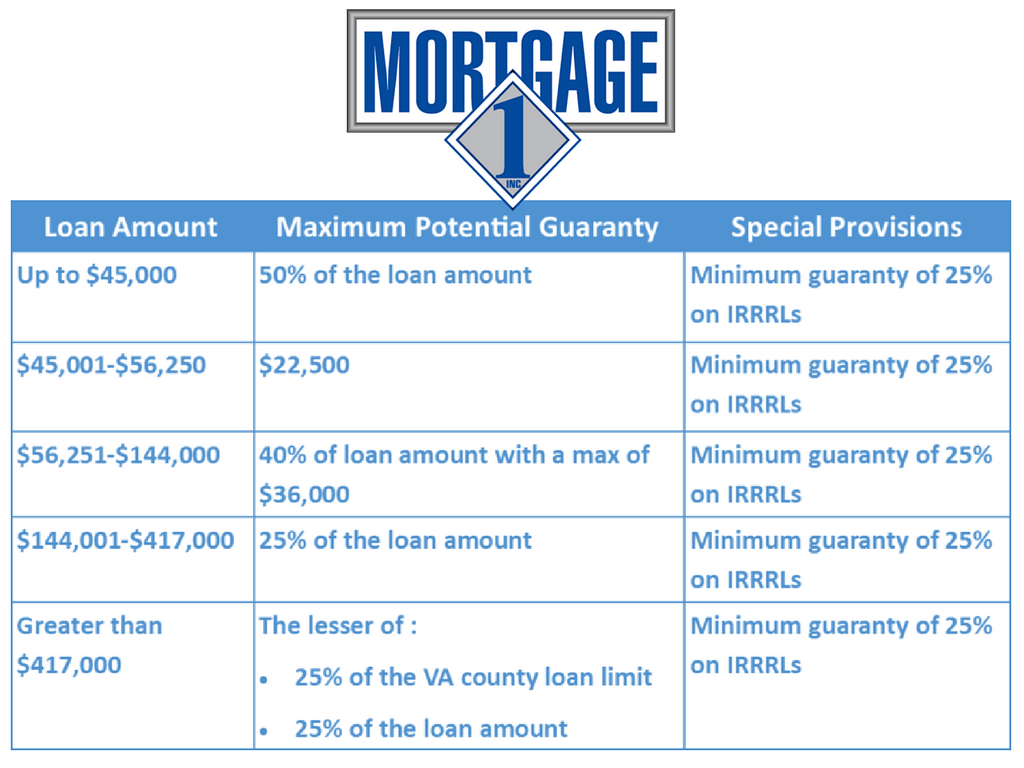

Note: The percentage and amount of guaranty is based on the loan amount including the funding fee portion when the fee is paid from loan proceeds.