Choosing a Realtor

January 19, 2022

Mike Archer Hits the Mark When It Comes to Helping Home Buyers and Others

February 2, 2022Becoming a homeowner isn’t as simple as finding a house and signing the papers. Find out what to expect at every step of the home-buying journey, from shopping for a mortgage to closing on your new house.

The path to home ownership starts well before you make an offer. For many home buyers, it starts before they even begin looking at houses.

| We Make Your Path to Home Ownership Easier! Talk with a Mortgage 1 loan expert to get personalized recommendations. Call us at 1-866-532-0550 or connect with a Mortgage 1 loan officer near you. |

Let’s see what you can expect at each stage of the home-buying process.

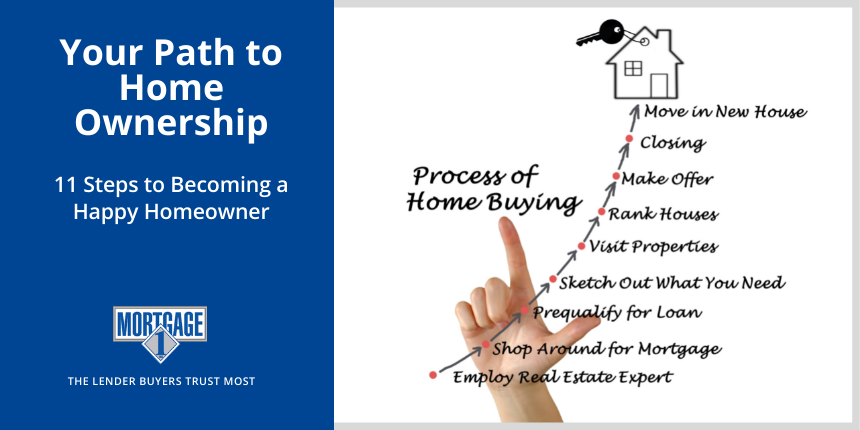

11 Steps to Home Ownership

Steps 1-3: Get Your Mortgage Sorted

Before you do anything else, you need to understand what you can afford. In other words, you need to take a close look at your finances. That kicks off the home-buying process.

Step 1: Do your homework. Before you can get pre-approved for a mortgage, the lender will need to know a lot of financial details. This includes your income, debts, credit score, credit history, employment status, and so on. Expected timeline: Depends on your situation.

Step 2: Go mortgage shopping. Once you’re crystal clear on your financials, find a mortgage lender. Look for someone that will work with you to improve your creditworthiness, explain all the costs and documentation entailed in a loan, and help you understand all the mortgage options available.

Step 3: Get pre-approved for a mortgage. This process entails the verification of your identity, finances, and assets. It helps the lender figure out what kind of credit risk you are and how much of a loan you can manage. When you make an offer on a house, being pre-approved for your mortgage can make you a much stronger candidate. Expected timeline: A few hours to days for a digital mortgage; a few weeks for a traditional paper-based mortgage.

Steps 4 & 5: Making an Offer

With a clear idea of what you can realistically afford, you can now go house shopping. Once you’ve decided on a place, this is what happens next.

Step 4: Make an offer. An Offer to Purchase Real Estate is a document describing the property, sale price, and other legal details; “making an offer” is submitting this document to the seller or their agent. Before you sign it, make sure you’ve agreed on the price and what (if any) contingencies may impact the sale. Expected timeline: 1 week.

Step 5: Get a home inspection. Next, a professional will examine the house to ensure it meets all safety requirements (and any requirements set by the mortgage lender). The actual inspection time is usually a few hours, but the timeframe for a buyer to have an inspection completed is about a week.

Steps 6-10: Mortgage Processing

With an offer in place and a home inspection passed, the focus now shifts to the mortgage lender. Here’s what’s going on behind the scenes as you wait to find out whether the deal will go through. The expected timeline for this entire process is 1-2 months, but it can be considerably shorter if you use a digital mortgage.

Step 6: Deliver updated paperwork. At this point, you’ve completed your formal loan application and delivered it to the mortgage company, along with any supporting paperwork or documents.

Step 7: Title search and property appraisal. Next, the mortgage company will usually order an appraisal of the home to ensure its value is commensurate with the loan amount. A title search will also be performed to spot potential legal issues (e.g. unpaid taxes, a lien on the property).

Step 8: Underwriting starts. During the underwriting process, underwriters will examine and verify all the documentation associated with your request. Although you’ve been pre-approved, this stage determines whether the mortgage company will actually grant you the loan. You may need to answer some questions or provide additional documentation during this step.

Step 9: Conditional approval. Once the mortgage underwriter is satisfied with your loan application, they will issue a conditional approval; essentially, this means the lender is willing to loan you the money.

Step 10: Final approval. It’s official! You’re now cleared for closing – the final step in your home-buying journey.

Step 11: Closing

A closing date will be chosen that suits you, the seller, and your lender. Usually, this date is at least a month after an offer has been accepted. During the closing process, you may have a final walk-through of the property. You’ll also need to make arrangements to pay the closing costs. Then you’ll sign the paperwork (it’s a good idea to review it thoroughly first). You’re a proud homeowner!

Your Path to Home Ownership Doesn’t Have to Be Rocky

Now that you have an overview of what to expect during the path to home ownership, you can see that it takes time, effort, patience, and money! If you need a helpful ally, contact your local Mortgage 1 loan officer. They can give you personal advice that will guide you through the entire home-buying process.