Mortgage 1 Inc, Named Top 10 Midwest Mortgage Employers

February 7, 2017

What is included in closing costs?

February 24, 201710 Steps toward a smooth mortgage transaction.

The Lending Professionals at Mortgage 1 have access to thousands of programs and the experience to custom tailor a loan that is right for every individual.

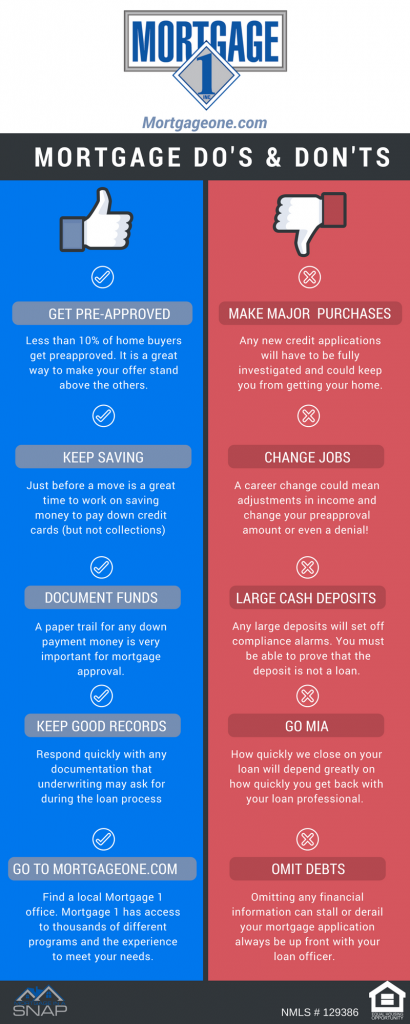

First-time home buyers, as well as consumers who have been through the mortgage process before, should keep these tips in mind:

- Future borrowers should review their future budget including the new mortgage amount ahead of time, to make sure they are comfortable with the new payments.

- Borrowers should not allow any new credit inquiries on their credit report. A new credit report will be pulled a few days prior to closing and all inquiries will have to be explained to an underwriter.

- Do not increase the balances of any existing credit accounts; it’s best to postpone all additional credit transactions until after the closing.

- Try not to make any job or negative income changes and don’t make any major purchases that could change your financial picture.

- Keep up to date on all income taxes, pay all your bills on time and don’t allow any overdrafts to checking accounts.

- All large deposits into bank accounts require source information, if they aren’t specifically identified on the statement, make copies of checks. Be prepared to offer explanations on the source of the deposit.

- Save paystubs and bank statements; they may be required to provide updates before closing.

- Notify us of any plans to be out of town during the mortgage process.

- Any changes regarding the details of the loan need to be reported to the lender to avoid complications and violations to the guidelines of a loan program.

- Check email often to ensure prompt receipt of time-sensitive documents or requests for information. Delaying acknowledgment could delay the loan process.

One or two days prior to settlement, the borrower should inspect the property one last time. Check that all items are as agreed to on the purchase contract. On the day of settlement, all those on title need to sign the closing documents. Bring valid photo identifications. Be prepared to spend a little more than one hour at closing. Ready to get started? Try our digital Mortgage called Mortgage in a SNAP

steps toward a smooth mortgage transaction.