What is included in closing costs?

February 24, 2017

8 Reasons a Borrower Should Choose an FHA Mortgage

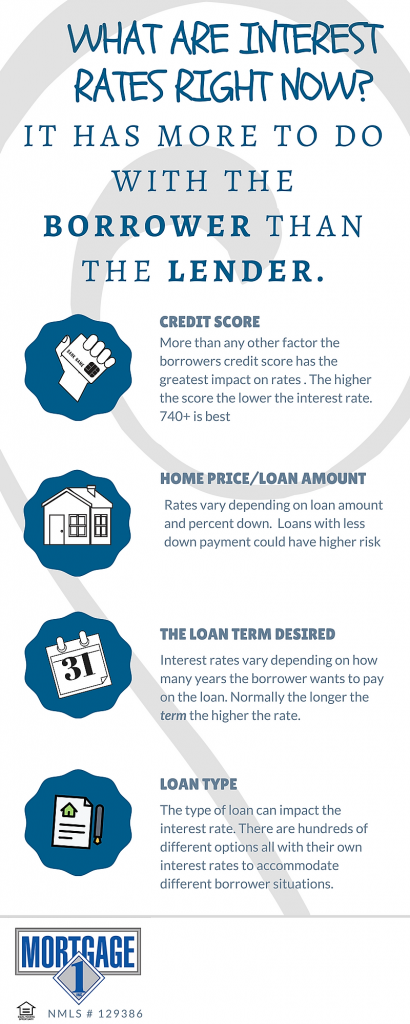

March 16, 2017What are interest rates right now? It has more to do with the borrower than the lender.

5 Ways Borrowers Impact Their Interest Rates.

1. Credit Score

More than any other factor, borrowers credit scores have the most significant influence on all types of borrowing. Mortgage rates vary considerably between credit scores of below 640 and above 740. Borrowers credit scores predict how likely borrowers will pay the mortgage loan on time. Borrowers have many credit scores and they should remember that the scoring model used by the Mortgage industry is specific to housing. The score they bought online will not be the same score that the lender uses.

2. Loan Amount

Borrowers pay a higher interest rate on loans if the loan amount is particularly small or very large loan. When borrowers apply for a smaller loan, the costs can make up a larger percentage of the total costs. To offset those cost sometimes the lender will have to charge a slightly higher interest rate for very small loans. When the loan amount gets very large the risk factors increase along with the interest rate.

3. Down Payment

The value of the home and the amount a borrower puts down can impact the interest rate. In general, a higher down payment means a lower risk and interest rates. Borrowers should strive to put down at least 20 percent if you want to get lower interest rates.

4. Loan Term

The term of the loan is how long the loan is for. Shorter terms normally have lower interest rates and lower overall costs, but will have higher monthly payments. If you can afford slightly higher payments shorter terms will reduce your costs of interest rates. Discuss what term is best for you with a Mortgage 1 Loan officer for your exact situation.

5. Loan Type

There are several broad categories of loans, known as conventional, FHA, and VA loans. Rates can be significantly different depending on what type of loan borrowers choose. You can learn more about the different loan types on our Website at Mortgageone.com

If you would like to find out exactly what your costs and interest rate custom tailored to your specific situation just go to SNAP Mortgage.

5 Ways Borrowers Impact their Interest Rates. What are Interest rates right now?