What is the Minimum Credit Score a Borrower needs to Obtain a Mortgage?

July 26, 2017

7 personal financial tips for mom and dad at back to school time.

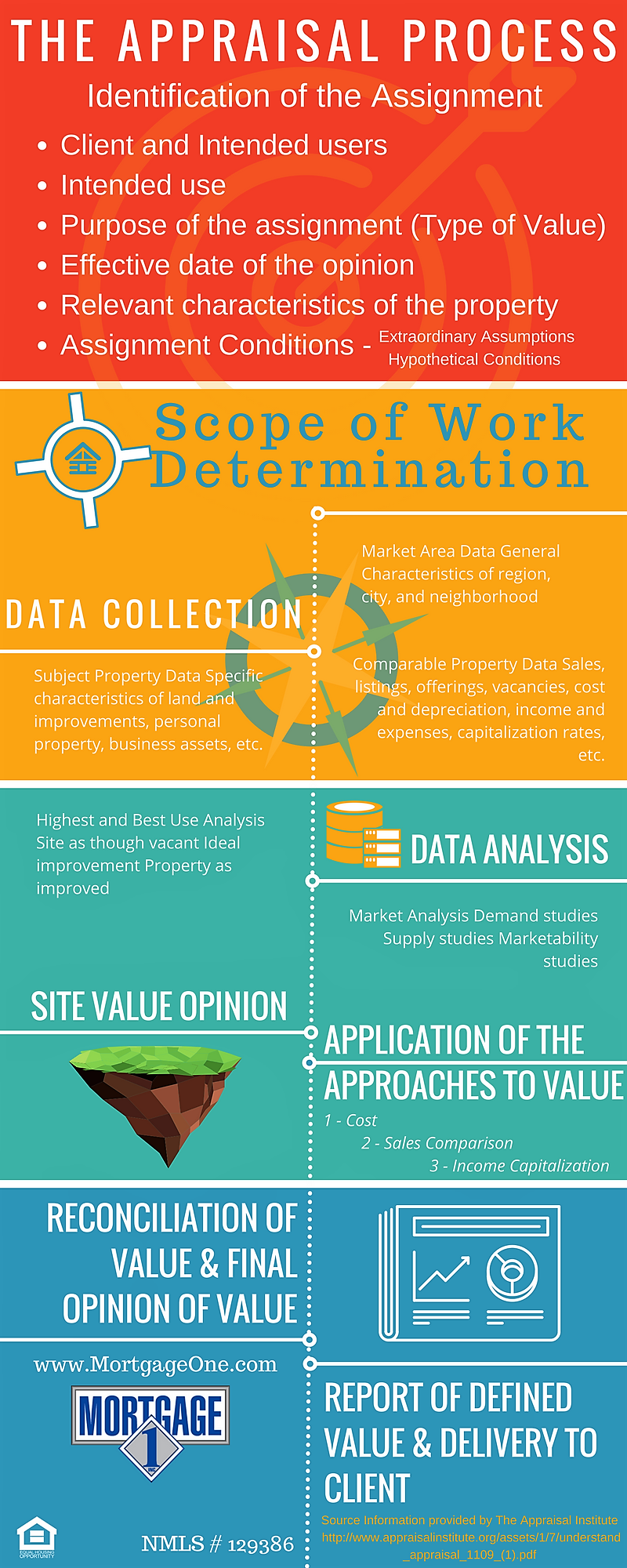

August 25, 2017One of the most confusing aspects of obtaining a mortgage can be the appraisal process. Most people think that because a home sold for a certain price, that price must be equal to the value of the home. The truth is the “sale price” has no impact on the appraisal value. The Appraisal is primarily based on other properties that have already SOLD in the same market area.

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property (usually market value)

The buyer is free to pay whatever they like for the home. If the buyer intends on getting a mortgage, then they are required to get some type of home appraisal. That opinion of value (the appraisal) is by its very nature a lagging indicator because it is based on properties (Comparable Properties) that have sold in the past.

So what is a Comparable Property?

It is properties with characteristics that are similar to a subject property. The appraiser is looking for similar square footage, floor plan, the number of rooms, type of rooms and location to name a few. The best comparable could be the home next door or a few miles away. The best Comparable would be the house next door with the same floor plan, upgrades, view, everything exactly the same as the subject property that closed the day before the appraisal assignment.

When the home next door is not available the appraiser will attempt to find homes as close as possible and make adjustments. The adjustments are added or subtracted from the comparable property in an attempt to equal the subject being appraised. If one comparable did not have a 2 car garage like the subject. The appraiser would add the approximate value of the garage to the comparable to bring it up to the subject. If the comparable had a 3 car garage the appraiser would subtract from the subject the value of the extra garage.

Licensed Appraisers are required to have two thousand hours of apprenticeship work under another appraiser plus 80+ hours of class room training then they are required to pass a state exam.

If you are ready to Start a Digital Mortgage Click here